Discover Insights and Strategies Shaping the Future of Retail Media

YOUR HUB FOR EVERYTHING RETAIL MEDIA

FEATURED RESOURCES

CASE STUDIES

Find Success Stories

From Companies Like Yours

Hershey’s CPG Sales Soar via Topsort Ad Network

Concha y Toro, Chilean Wine Giant, Achieves 10.3x ROAS

Despegar Engages 30M Travelers via Sponsored Listings

La Rebaja Pharmacy Rockets Ad Revenue 137%

Poshmark Powers 40% Ad Gains for Fashion Sellers

YouTravel Boosts Vendor Sales $35K

Daki, Delivery App, scales ad spend with sponsored listings

INSIGHTS BY EXPERTS

Learn From Leading

Voices In Retail Media

TOPSORT BLOG

Explore Industry Trends, Product Innovations, and Insider Stories

W23 Global is backed by Tesco (UK, ROI, Europe), Ahold Delhaize (US, Europe, Indonesia), Woolworths Group (Australia, New Zealand), Empire Company Limited/Sobeys Inc. (Canada) and Shoprite Group (Africa). Topsort is setting new global standards for how retailers, brands, and agencies activate, optimize, and measure retail media

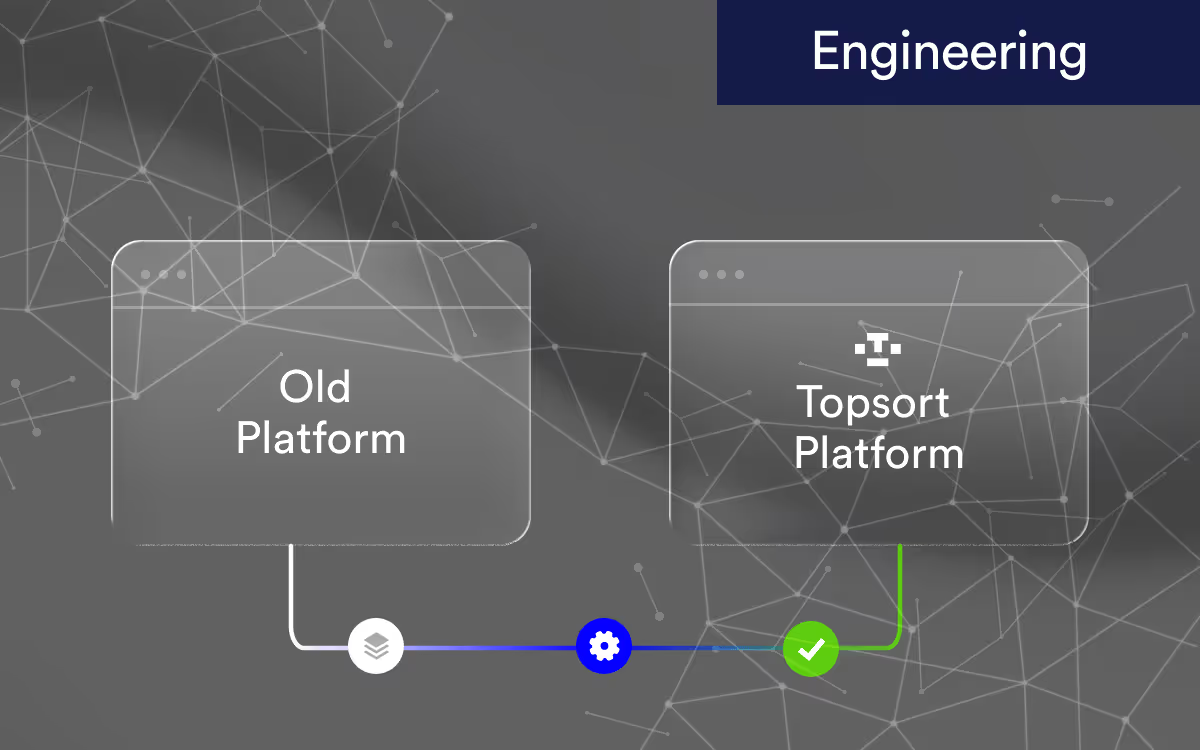

Migrating a live advertising platform from one provider to another is one of the most high-stakes operations a marketplace can undertake. It's a complex process where even minor data inconsistencies can have devastating consequences.

Latest

NEWSROOM

Top News

From Topsort